Some Ideas on Feie Calculator You Need To Know

Table of ContentsThe Buzz on Feie CalculatorThe smart Trick of Feie Calculator That Nobody is Talking AboutThe Definitive Guide to Feie CalculatorThe 30-Second Trick For Feie CalculatorThe smart Trick of Feie Calculator That Nobody is Discussing

He sold his United state home to establish his intent to live abroad completely and used for a Mexican residency visa with his better half to aid satisfy the Bona Fide Residency Examination. Neil aims out that purchasing home abroad can be challenging without first experiencing the location."We'll certainly be beyond that. Also if we return to the US for doctor's appointments or company phone calls, I doubt we'll spend more than thirty day in the United States in any given 12-month period." Neil stresses the significance of stringent tracking of united state sees (Taxes for American Expats). "It's something that people need to be truly thorough regarding," he states, and encourages deportees to be mindful of common mistakes, such as overstaying in the U.S.

Not known Factual Statements About Feie Calculator

tax responsibilities. "The reason that U.S. taxes on worldwide income is such a big deal is because many individuals neglect they're still subject to U.S. tax even after moving." The U.S. is one of minority countries that taxes its citizens despite where they live, meaning that also if a deportee has no revenue from U.S.

tax return. "The Foreign Tax obligation Credit allows individuals operating in high-tax countries like the UK to counter their united state tax obligation obligation by the amount they have actually already paid in taxes abroad," claims Lewis. This makes sure that expats are not taxed twice on the same earnings. Those in low- or no-tax nations, such as the UAE or Singapore, face extra obstacles.

The smart Trick of Feie Calculator That Nobody is Discussing

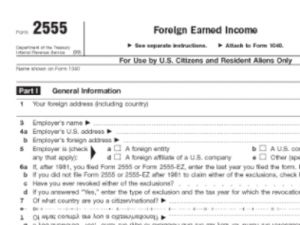

Below are a few of the most often asked concerns concerning the FEIE and various other exclusions The International Earned Earnings Exemption (FEIE) permits united state taxpayers to omit as much as $130,000 of foreign-earned revenue from government earnings tax obligation, minimizing their united state tax obligation responsibility. To get approved for FEIE, you must meet either the Physical Visibility Examination (330 days abroad) or the Authentic House Examination (verify your primary residence in a foreign nation for a whole tax obligation year).

The Physical Presence Examination additionally calls for U.S (Taxes for American Expats). taxpayers to have both a foreign earnings and an international tax home.

More About Feie Calculator

An earnings tax obligation treaty in between the united state and an additional nation can help protect against double taxation. While the Foreign Earned Income Exemption lowers gross income, a treaty might give extra advantages for qualified taxpayers abroad. FBAR (Foreign Bank Account Record) is a needed declare U.S. citizens with over $10,000 in international monetary accounts.

Eligibility for FEIE depends on meeting particular residency or physical presence tests. He has over thirty years of experience and now specializes in CFO services, equity compensation, copyright taxes, marijuana tax and divorce associated tax/financial preparation issues. He is a deportee based in Mexico.

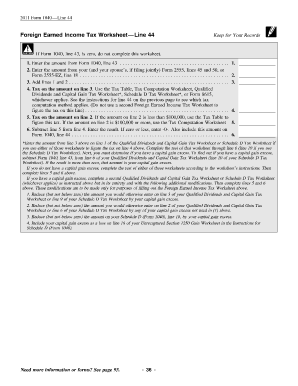

The international earned income exemptions, sometimes described as the Sec. 911 exemptions, leave out tax obligation on incomes made from functioning abroad. The exemptions comprise 2 components - a revenue exclusion and a real estate check my reference exemption. The complying with Frequently asked questions discuss the advantage of the exemptions consisting of when both spouses are deportees in a general way.

Some Known Facts About Feie Calculator.

The tax benefit excludes the income from tax at bottom tax prices. Formerly, the exemptions "came off the top" reducing income subject to tax at the top tax rates.

These exclusions do not excuse the earnings from United States taxes but merely supply a tax obligation decrease. Note that a single person functioning abroad for all of 2025 that earned concerning $145,000 without any various other earnings will certainly have taxable earnings decreased to absolutely no - effectively the very same response as being "free of tax." The exemptions are calculated each day.

Comments on “Facts About Feie Calculator Revealed”